At press time, the Adidas NMD White Monochrome was up 150% with the last sale at $300. The Nike Jordan 4 Retro White Cement, however, was down 15% with a last sale of $255.

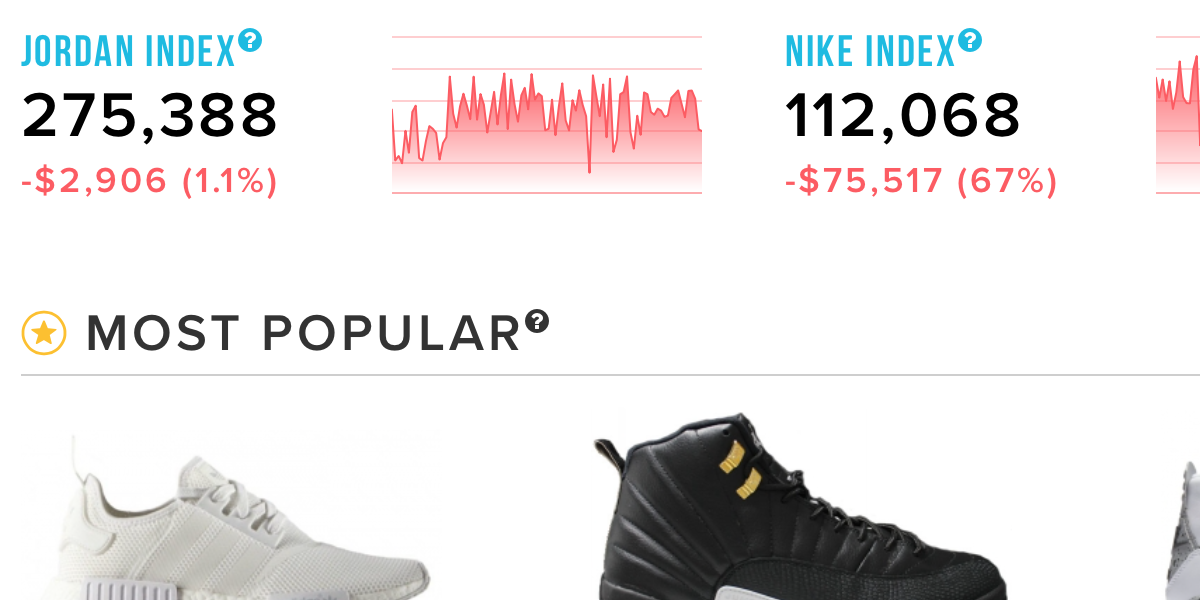

If this data means nothing to you, it may because you’ve yet to visit StockX, which describes itself as a “stock market of things” that’s launching with a focus on sneakers. Much like the traditional stock market, sneakers are sold when sellers put out an “ask” that is matched by a buyer’s bid. Using data from eBay and other sources, the company offers real-time valuations of sneakers which aims to offer the most fair price for a particular brand. Unlike online auctions such as eBay, however, all goods are sent directly through StockX to ensure the sneakers are authentic.

StockX CEO and co-founder Josh Luber told Marketing the company evolved from his previous startup, Campless, which collected and sold data about the sneaker market directly to companies and offered pricing guides. Around this time last year, however, he was approached by Detroit real estate mogul Dan Gilbert, who is now an investor and co-founder.

“It’s just a unique method of connecting buyers and sellers that the world’s stock markets use,” said Luber, who is among the speakers at CMDC’s Vision 20/20 conference in Toronto on Tuesday. “That construct of giving both parties – the buyer and the seller – the opportunity and the choice to transact immediately on whatever the market price is – that only exists for the actual stock market. It makes sense that you should be able to do that for consumer goods, assuming there is some liquidity and standardization of the product.”

If StockX is successful it could become an interesting barometer for marketers who want to better understand the economics of brand affinity, particularly if it evolves beyond sneakers. Luber said the model should work for almost any product that isn’t commoditized (like toilet paper, for example), or that isn’t a one-of-a-kind item like a work of art.

“We do think there’s opportunity for brands to engage on the resale market,” he said, citing sneakers that sell for $200 but later resell for $1,500. Retailers may also want to consider letting the market more strongly influence what kind of discounts they offer at the end of a season rather than arbitrarily marking items down by a certain percentage. “A stock market is essentially a variable pricing model that automatically moves with the market to what is a true market price.”