BlackBerrry shares got a kick in the pants on Wednesday when word got out that the company was in talks to be bought by Samsung.

Reuters reported the South Korean company had offered up to $7.5 billion for BlackBerry, which sent the stock soaring 30%. BlackBerry hasn’t seen that kind of valuation since the iPhone was in its rear-view mirror many years ago.

Both companies were quick to pour cold water on the report, sending the shares back down.

Many observers scratched their heads. Why would the struggling Waterloo, Ont.-based company — whose share of the global smartphone market is now a paltry 1% — not cash in and get while the getting is good?

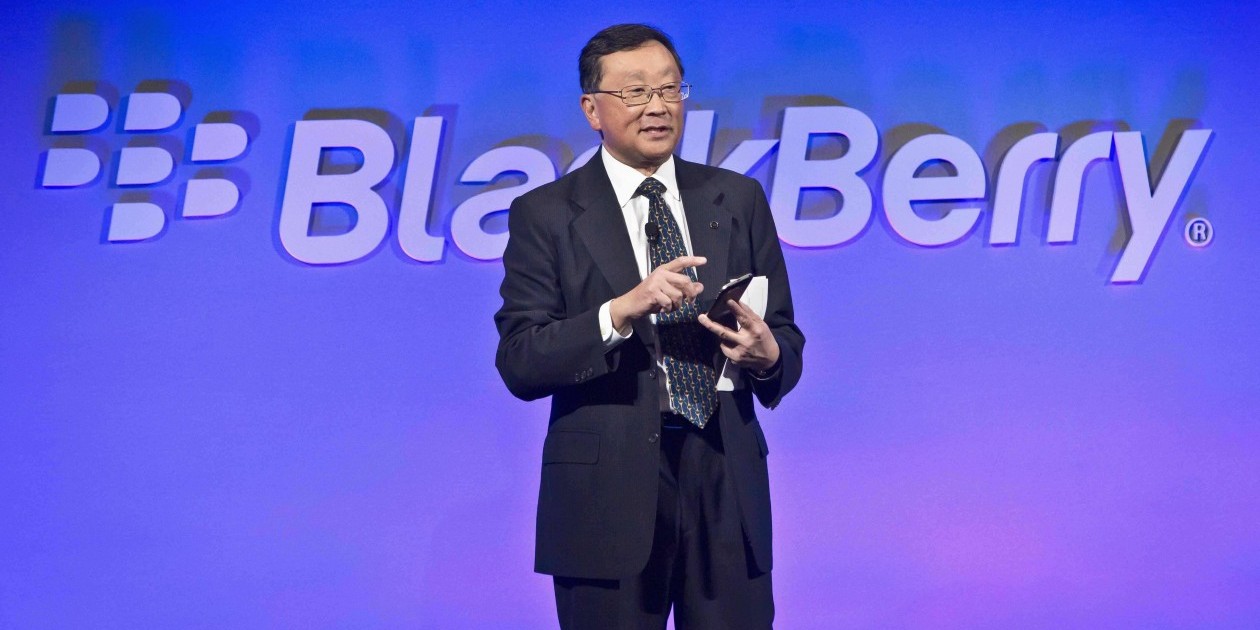

It’s simple: chief executive John Chen, who took the reins at BlackBerry in November 2013, believes the company is worth more than that.

Last week at the Consumer Electronics Show, BlackBerry outlined its plan to become the focal point of the internet of things (IoT), the buzz phrase that represents connection and communications between all devices, appliances and vehicles.

It’s a relatively solid plan. BlackBerry plans to use its reputation for secure communications and QNX, its well-regarded operating system that’s found in everything from phones to cars to nuclear power plants, to build a cloud-based platform that can control everything from home appliances to industrial machines.

The market for connected things is growing rapidly, going from 5 billion in 2015 to 25 billion in 2020, according to Gartner.

Given that opportunity, it’s no surprise Chen doesn’t want to sell without first giving it the old college try. If BlackBerry can capture a decent chunk of that nascent market, it could indeed end up worth more than $7 billion.

But BlackBerry faces at least two big obstacles to its IoT strategy.

The first is that it’s starting from zero on the consumer front. Very few of the connected consumer goods already available, from bathroom scales to thermostats to toy drones, are BlackBerry compatible – they work exclusively with iOS and Android.

That’s not an insurmountable barrier, as Android apps can be modified to work on BlackBerry, but still, someone has to do that work.

The other, bigger obstacle, is BlackBerry’s likely competitor for the IoT: Google. For the past few years, the search engine company has been quietly preparing for a future in which everything is connected.

Its ongoing development of autonomous cars, its shopping spree for robotics companies such as Boston Dynamics, as well as its recent splurging on connected-device makers such as Nest Labs and Dropcam all signal that Google is also positioning itself as an IoT player.

Google’s advantages are myriad. Its software is already ubiquitous, it has widespread acceptance among consumers and businesses alike, and it’s coming at the IoT from a position of strength, rather than as a last-ditch effort.

Apple is looking to be a force too, but so far it hasn’t made the sorts of long-term bets that Google or even BlackBerry have, which sets up an interesting dynamic between the three companies.

Apple, with its HomeKit and CarPlay technologies, looks to be targeting the front end of the IoT – the part that consumers see. BlackBerry, by virtue of its nearly non-existent relevance with consumers, looks to be aiming for the back end. Google, however, is uniquely positioned to address both areas.

As such, it’s understandable why BlackBerry would spurn a takeover offer at this point. With the IoT market wide open, there’s still a strong possibility that the company could find itself with a decent piece of the pie.

Moreover, if that three-way dynamic is considered, a BlackBerry-Apple tie-up could make more sense than a Samsung acquisition.

This article originally appeared at CanadianBusiness.com.